Before we begin, this article is written for somebody with a moderate to high-level technical understanding. This is not a step by step tutorial on how to boost website performance, but rather its an information piece designed to give high-level management people a glimpse into how website performance works and how it can affect your organization’s technology.

Before we begin, this article is written for somebody with a moderate to high-level technical understanding. This is not a step by step tutorial on how to boost website performance, but rather its an information piece designed to give high-level management people a glimpse into how website performance works and how it can affect your organization’s technology.

Executive Summary

Web optimization is a term that has multiple meanings. There is value in each. But when we speak of web performance optimization we specifically mean the speed at which your site loads and how well it responds to user actions. Poor performance can have far-reaching effects from abandoned sessions to reduced revenue. Investing in the performance of your web pages and apps can increase site usage, increase conversions, and even result in reduced hosting costs. There are several simple strategies that can help improve your web site’s performance and experts that can assist your organization in increasing the value of your web properties through optimization.

An Introduction to Web Performance

Websites have become as ubiquitous for the modern business as a company name or logo. Regardless of an organization’s size or purpose, a website is a cost of entry item for running a business. Meaning, whether a company has a site or not, you can be sure their competition does.

We are also well past the days of a site simply being a digital brochure. Dynamic page elements, product and service images, blogs, and forms are common website elements for all but the smallest organizations.

These sites no longer end at the desktop, either. Having a mobile experience is critical in a world where, according to consumer insight and research firm Hitwise, 58% of searches are now executed on a mobile device.

Extending beyond websites, today’s companies also host full-blown web applications, portals, and intra- and extranets. These integral pieces of an organization’s offerings and workflows go well beyond a simple HTML site. What all of these experiences have in common, no matter the purpose or intent of the web property is the need for a performant and seamless experience. Research from such experts as the Nielsen-Norman group has shown that users have expectations from websites and applications, and not meeting those expectations can result in unexpected and unwanted user behavior.

Why Companies Should Care About Web Site Performance

It’s easy as easy to say that a site should perform well, and just as easy to say that it’s not a priority for an organization if the full impact of the poor performance isn’t known. However, the impact of a slow or clunky site is both significant and well documented.

Performance and Visitor Expectations

Performance and Visitor Expectations

Site visitors have high expectations of web experiences. While one-tenth of a second feels instantaneous to a user, and one second still appears seamless to users, more than that can lose a site visitor forever. According to research conducted by Akamai Technologies, 18% of users expect a page to load instantly, which typically translates to 3 seconds or less. When it takes more than 3 seconds for a site to load, 40% of visitors will abandon the site.

When Facebook reviewed how performance affected traffic to its pages, they saw a 3% drop off in traffic in pages that loaded 500 milliseconds slower than other pages, and twice the dropoff rate on pages that took 1000 milliseconds more to load.

The effect is amplified for mobile site visitors. Akamai found that 74% of users will abandon a site that takes more than 5 seconds to load, and 46% of mobile visitors will not return to a site that performs poorly.

The Importance of a Well Performing E-commerce Site

E-commerce sites are one of the easiest places to understand the direct impact of site speed improvements in relation to revenue and conversions, both because there is a direct revenue component that can be measured as well the substantial influence performance has on shoppers. Research shows that slow sites can influence shoppers across the entire experience, from initially landing on a site all the way through to check out.

As common as online shopping is today, many consumers are still leery of these experiences, especially for lesser-known or smaller online stores. Slow site performance only increases their hesitance. In a survey conducted by Radware, 44% of online shopper responding to the survey said they become anxious about the success of their transaction if a site is slow, with 51% of shoppers saying they will abandon a shopping cart on a slow site.

While not all carts are abandoned because of site performance, abandoned purchases result in an estimated global loss of $4.9 trillion to businesses. Any revenue recaptured from abandoned carts is a win for an online store.

Beyond the immediate concern of abandoned carts and sessions, slow sites can have a future impact on shoppers as well, having been shown to leave a poor perception of the overall brand.

Site Slowdowns Can Increase Hosting Overhead

Certainly, visitor and customer experience and their subsequent reactions to a slow site are important to an organization. However, a slow site can also have a direct effect on your business costs.

Many third-party hosting companies charge organizations for the bandwidth used to deliver their web pages to users after a certain volume has been reached.

This presents a conundrum for companies. They are willing to pay for that bandwidth because it means more visitors are coming to their site. But one of the reasons that sites may be slow is because of bloated resources used by the page. Organizations may be unnecessarily paying to have large pages delivered to visitors, while at the same time those visitors are frustrated by the slow response time of the site.

This is an issue for companies hosting their sites on their own servers, too. Bloated resources on web properties require they use more storage than is necessary or allocate greater bandwidth to their websites and applications than is actually needed.

What is Web Performance Optimization?

The data makes it clear that web performance is a priority issue for any organization concerned with its website visits and online commerce. The process of improving the performance of your sites and applications is referred to as web performance optimization. While some refer to web optimization as improving the searchability of their website through improving SEO and SEM, web performance optimization is specific to the activities and testing related to performance..

The data makes it clear that web performance is a priority issue for any organization concerned with its website visits and online commerce. The process of improving the performance of your sites and applications is referred to as web performance optimization. While some refer to web optimization as improving the searchability of their website through improving SEO and SEM, web performance optimization is specific to the activities and testing related to performance..

Budgets, of course, can be an issue. Budget restrictions may put a company in the position to choose between search engine optimization and performance optimization. In those instances, it’s important to remember that the performance of your website will have an effect on search engine optimization as well – site speed is a factor used by Google when setting search rankings.

Once an organization has decided to prioritize performance optimization you can begin formulating a plan to address any issues.

There are two phases to building a performance optimization plan. The first is to quantify the current site’s performance. This serves two purposes – the first makes it clear where efforts should be focused, and the second builds a set of benchmarks for understanding if the implemented optimization strategies addressed the issues found.

The second phase, of course, is executing on optimization strategies specific to the issues discovered. While it may sometimes be difficult to know exactly what needs to be optimized, implementing the most obvious and easiest strategies, and comparing the results to the benchmarks from the first phase, will indicate where future work should be focused.

Measuring A Site’s Experience

Measuring the performance of a site requires more than simply pulling up the site and noting how long it seems to take for it to load. While this subjective test may indicate a problem, it won’t provide the appropriate metrics required to ensure optimization efforts are meaningful and successful.

Where to Begin

The ideal place to start benchmarking a site’s performance is with a tool built specifically for performance testing. Using the same tool to understand the initial metrics of the site and the subsequent measurements after optimization tactics have been implemented to ensure consistent results for comparison.

Not all site visitors enter from the home page. Thanks to search optimization efforts, a site user may land on almost any page on a company’s site, from homepage to blog posts to product and services pages. Testing internal pages will ensure that no matter how a visitor finds a site they are receiving the best, most optimized experience.

Testing should also encompass both client-side speed and server-side performance. Knowing where issues are occurring focuses optimization efforts, giving the biggest improvements with the least work while ensuring that teams are not playing hunt-and-peck with optimization strategies.

Testing Tools

Organizations must choose whether to use free, open source or paid tools. The decision should be made based on the resources available to perform the testing and the skill set of the team.

Free tools may provide only a very high-level understanding of site performance issues, which may be appropriate if an organization is only willing or able to commit limited internal resources to optimization efforts.

If, instead, a company has skilled developers and testers able to commit time to customize an open source tool, deeper and more meaningful testing can be accomplished, resulting in a clearer direction for improvements.

There are also commercial development and testing tools, like Microsoft’s Visual Studio, that has built-in functionality for web performance testing. If an organization has already invested in a professional development or testing tool with site speed and load testing features, using that for the various benchmark and follow-up performance testing makes sense.

But for many organizations, even using a simple, free tool is beyond their abilities or resource availability. Yet they are still impacted by the effects of a poorly performing website. In those instances, organizations should find a trusted partner with extensive experience in web development and performance testing. Such a partner can quickly identify the most critical issues and remediate them.

Even organizations that have the appropriate resources can benefit from a partner experienced in performance testing and improvements. Leveraging the skills and experience of a partner allows existing resources to remain focused on crucial tasks. And with extensive experience in performance issue remediation, a consulting firm can find and fix problems quickly.

What to Test

There are simple tools that give you a basic answer, or score, indicating how a site performs. Google’s free PageSpeed Insight Tool, for instance, gives a site score out of 100. When looking for a more in-depth understanding of where the web experience slows down, specific metrics can be used to gain insight into slowdowns and issues.

Time to First Byte

This metric measures how long it takes for a browser to receive the first byte of data from a web server indicating the web server’s responsiveness.

Full Page Load

Full page load, or time to the last byte, is a measurement that reports how long it takes for the given page to load completely. If the time to the first byte is fast, but time to the last byte is slow, it can point to an issue on the page itself.

Geographic Performance

If a site has global visitors, it’s not enough to only understand how the site performs in the company’s local region. Geographic Performance measures the responsiveness of the web property in various other regions around the world.

Load Testing

Several types of tests fall under the category of load testing, including Stress Tests, Ramp Tests, and Server CPU Load testing. All of these measures how a site or application performs when placed under the stress of many connections.

Database Performance

Sites that are dependent on dynamic elements or content served from a database, like many CMS-driven sites, or those that store data retrieved from the sites can be adversely affected by a slow database. Measuring the responsiveness of a web property’s database can point to the need for database optimizations

Strategies for Improvement

There is a myriad of strategies that can be used to fine-tune the performance of your site. Listed here are some of the low hanging fruit of performance optimization techniques – those that will solve many problems and are likely to produce the biggest impact.

Optimize Images

According to a survey completed by KeyCDN, 46% of web performance experts stated that image optimization should be the number one focus for anyone looking to improve web performance. Even saving an image at the proper size instead of forcing a browser client to download a large image and resizing can save precious milliseconds.

Caching

Caching allows sites to keep static web content in memory instead of returning to the server constantly to retrieve content and images that don’t change frequently. Modern content management systems (CMS) offer the ability to configure caching for a site.

Reduce HTTP Requests

Browsers contact the server to request web pages through a protocol called HTTP. Each HTTP request made to the server from the browser takes time. If a site or application is making many HTTP requests to load properly, a page can take longer to load than is really necessary.

Shrink CSS and Script Resources

Clean code in a CSS or JavaScript file is pleasant to read, but a browser processes each character in these files. Every comment, new line, and instance of whitespace is sent to the browser and require time to be parsed. Minimizing these elements reduces page load time.

Partners for the Best Site Performance

Tweaking every millisecond of performance out of a web property leads to increased conversions, higher revenue, and better search engine rankings. But not all organizations have the resources with the right skills or the time to tackle web performance improvements.

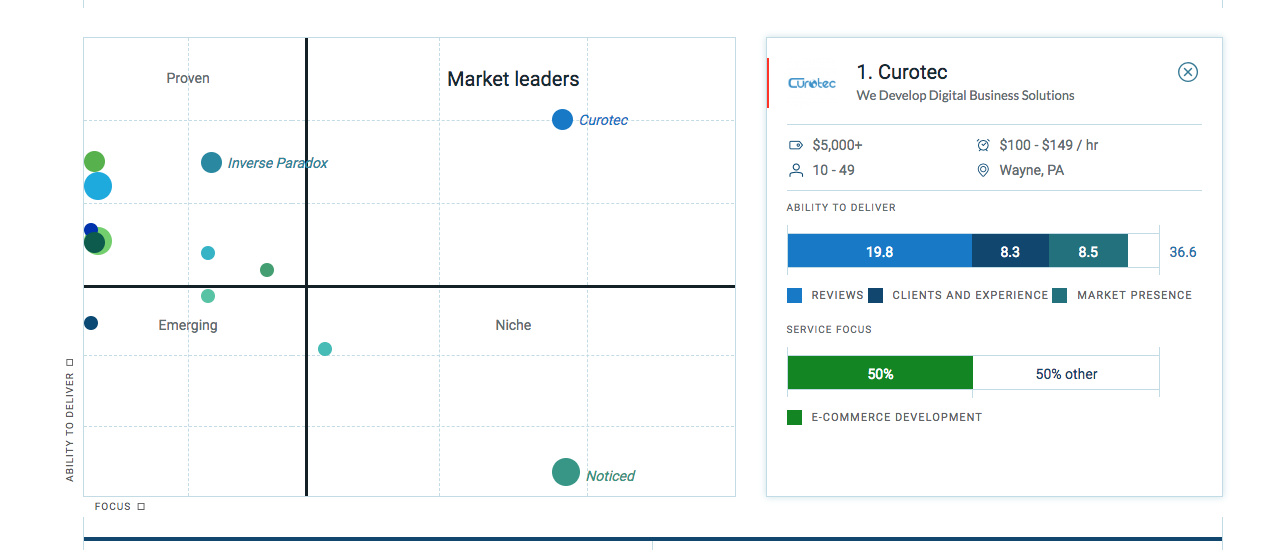

However, increased web performance for these organizations is not a lost cause. Curotec has experts that can review a website or application and identify where the most performance gain can be realized. They know the tools and tuning strategies that can enhance an organization’s web properties performance. And in the end, Curotec can save you money by quickly finding and fixing performance issues, allowing your team to remain focused on your other business objectives.

Contact us if you’d like to consult with us about your web performance challenges.

The post

Getting the Fast Website Load Times – A Web Performance Overview originally appeared on the

Curotec Blog

A look at the event

A look at the event

Salesforce is a Customer Relationship Management (CRM) platform that can provide many benefits for your business, allowing you to track important data and effectively implement your growth strategies. It is used by both large and small businesses working in a vast number of industries. The Salesforce platform provides a

Salesforce is a Customer Relationship Management (CRM) platform that can provide many benefits for your business, allowing you to track important data and effectively implement your growth strategies. It is used by both large and small businesses working in a vast number of industries. The Salesforce platform provides a  Microsoft Dynamics NAV

Microsoft Dynamics NAV Sage Intacct

Sage Intacct NetSuite

NetSuite QuickBooks Online (QBO)

QuickBooks Online (QBO) Xero

Xero Business Intelligence (or BI) is a hot topic in the business world these days. Although it doesn’t gain quite the number of headlines that blockchain and the Internet of Things do, it isn’t because of a lack of importance. In fact, depending on your organization, Bi might be far more relevant, and certainly more immediately important to you.

Business Intelligence (or BI) is a hot topic in the business world these days. Although it doesn’t gain quite the number of headlines that blockchain and the Internet of Things do, it isn’t because of a lack of importance. In fact, depending on your organization, Bi might be far more relevant, and certainly more immediately important to you.

Before we begin, this article is written for somebody with a moderate to high-level technical understanding. This is not a step by step tutorial on how to boost website performance, but rather its an information piece designed to give high-level management people a glimpse into how website performance works and how it can affect your organization’s technology.

Before we begin, this article is written for somebody with a moderate to high-level technical understanding. This is not a step by step tutorial on how to boost website performance, but rather its an information piece designed to give high-level management people a glimpse into how website performance works and how it can affect your organization’s technology. Performance and Visitor Expectations

Performance and Visitor Expectations The data makes it clear that web performance is a priority issue for any organization concerned with its website visits and online commerce. The process of improving the performance of your sites and applications is referred to as web performance optimization. While some refer to web optimization as improving the searchability of their website through improving SEO and SEM, web performance optimization is specific to the activities and testing related to performance..

The data makes it clear that web performance is a priority issue for any organization concerned with its website visits and online commerce. The process of improving the performance of your sites and applications is referred to as web performance optimization. While some refer to web optimization as improving the searchability of their website through improving SEO and SEM, web performance optimization is specific to the activities and testing related to performance.. 145.5 million.

145.5 million.

We’ve come a long way since the early days of the Web. Back in the 90’s, web pages were mostly text and images, especially large ones, were interlaced GIFs. All of this was done to save time and bandwidth and allow pages to load faster.

We’ve come a long way since the early days of the Web. Back in the 90’s, web pages were mostly text and images, especially large ones, were interlaced GIFs. All of this was done to save time and bandwidth and allow pages to load faster.